In her journey over the past 20 years, Shahnaz recognized that females business owners are likely to be less effective than guys in raising capital for their endeavors. She related such a tale from her first venture in handmade items in New york city, where Silicon Valley venture capital firms showed little interest.

” It is two times as difficult when you’re a female. And it’s 3 times more difficult when you’re a woman of color.” Shahnaz was smarter when she introduced IIX 10 years ago. She decided to remain in the background as IIX tackled its pitches – debt investors cobalt. “I had Caucasian guys, Indian males and Chinese males fronting me so that they would be speaking with the investors,” she stated.

If an Indian man is speaking with an Indian financier, suddenly the threat factor decreases. And if a Caucasian man is talking to an Asian investor, the danger aspect goes down.” Shahnaz admitted that although that decision to stay in the background was “a favorable one,” it was “a hard thing to do.” But it made good sense to her when she realized that it was not about her being the business owner.

And it has to do with bringing millions of individuals, and ladies, into a system which they’re barred from. If that indicates I need to stay back and get them in front, I will do it (lone tree lone Tysdal).” Today, IIX has “many stakeholders and well-wishers,” and in addition to its Women’s Livelihood Bonds, it has the biggest equity crowdfunding platform worldwide for impact investing, she said.

Choi is positive about the future for sustainable investing in part because of “the inputs and excitement of the next generation.” She noted that over the previous six years, Morgan Stanley has actually had a partnership with Kellogg School of Management for a Sustainable Investing Difficulty, where college students around the world are invited to submit their best concepts “for a financial product to be scalable, to ultimately mature to be a genuine capital markets instrument that intends to be rewarding.” Choi captured the spirit of the students who take part in the Sustainable Investing Challenge by recalling conversations with them. athletes sports agencies.

Why were you thinking about doing something that integrated finance and impact in this method?’ So often, they look at us nearly bewildered and state, ‘Well, why would you not?'” The next generation wants to integrate sustainability into its financial investment choices, she said. “They anticipate to have sustainability alternatives in their retirement prepares that their companies use them.

Denver Business Broker

They’re two times as most likely to choose items based upon sustainability. And they’re likewise twice as likely to boycott item, business or investment techniques that do not think about sustainability.”.

Impacting investing objectives to generate specific useful social or environmental impacts in addition to monetary gains. Impact investments may take the type of numerous possession classes and may lead to many specific results. The point of impact investing is to utilize cash and financial investment capital for favorable social outcomes. private equity firm. Impact investing refers to an financial investment method that not only generates monetary returns but likewise produces useful results.

Impact investing draws in people along with institutional investors consisting of hedge funds, private foundations, banks, pension funds, and other fund managers. Impact investments come in several types of capital and investment vehicles. Like any other kind of financial investment class, impact financial investments provide investors with a range of possibilities when it comes to returns.

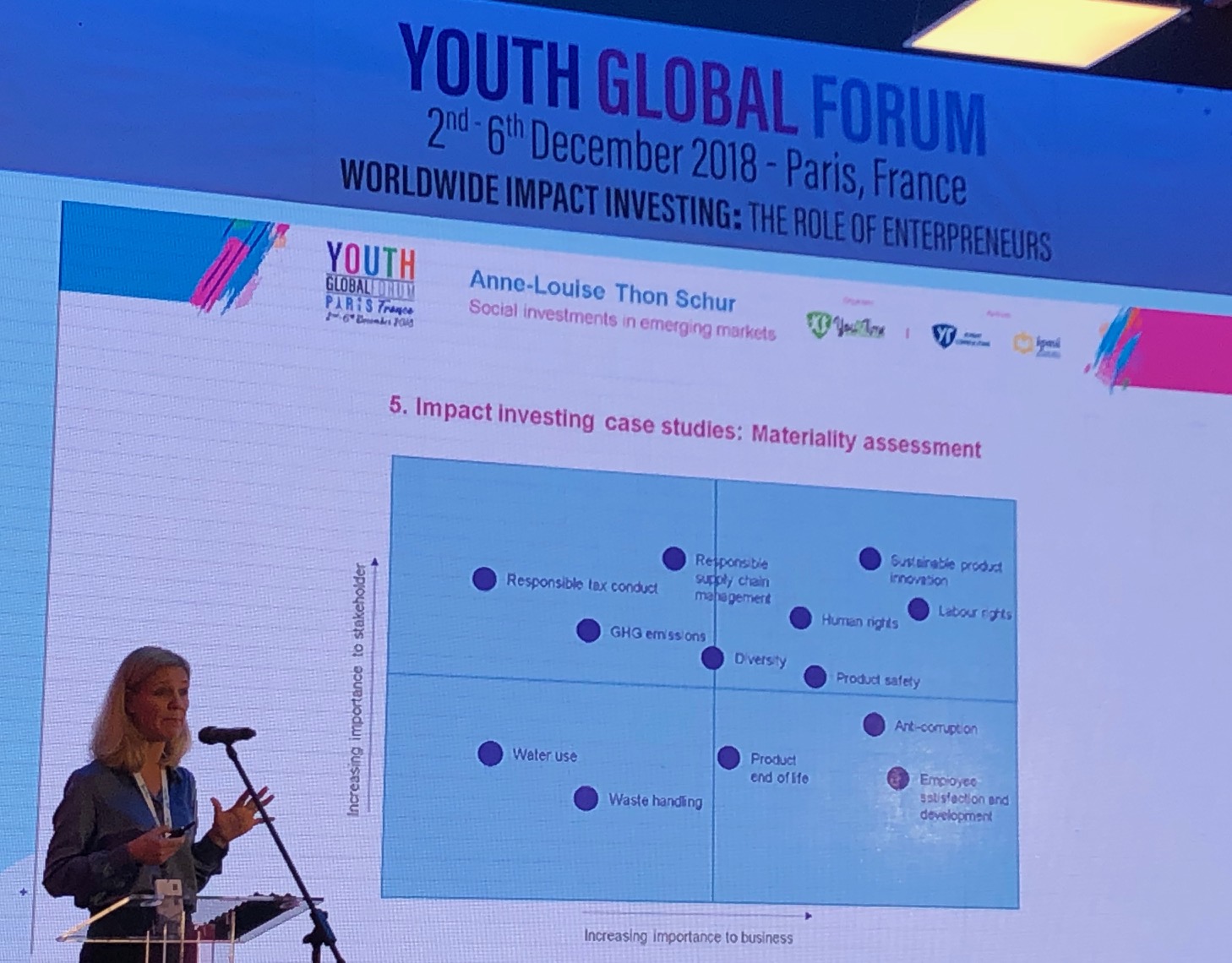

According to a survey by the Global Impact Investing Network (GIIN), the bulk of investors who choose impact investing appearance for market-rate returns. The opportunity for impact financial investments differs and investors might select to put their cash into emerging markets (EM) or established economies. Impact financial investments cover a variety of markets consisting of: HealthcareEducationEnergy, particularly clean and renewable energyAgriculture An example of an “impact investment” is one that would return to the neighborhood by helping less lucky groups of individuals (state prosecutors mislead).

A basic goal of impact investing is to assist decrease the unfavorable impacts of business activity on the social environment. That’s why impact investing might sometimes be thought about an extension of philanthropy. Investors who use impact investing as a strategy consider a business’s dedication to business social responsibility (CSR), or the sense of duty to positively serve society as a whole, before they become included with that business.

The bulk of impact investing is done by institutional investors, however a variety of socially mindful monetary service companies, web-based investment platforms, and financier networks now offer people a chance to take part in it. One major place is microfinance loans, which provide small-business owners in emerging nations with startup or expansion capital.

Business Partner Grant

Impact investing refers to a financial investment technique that not only creates monetary returns but also produces a positive social or ecological impact. Investors who follow impact investing consider a company’s commitment to corporate social obligation or the responsibility to positively serve society as a whole. Because socially and ecologically responsible practices tend to bring in impact investors, companies can benefit economically from dedicating to socially responsible practices, and investors likewise tend to profit.

Impact investing appeals mainly to younger generations, such as millennials, who want to return to society, so this pattern is most likely to broaden as these investors gain more impact in the market. By engaging in impact investing, individuals or entities basically specify that they support the message and the mission of the company in which they’re investing, and they have a stake in the company’s welfare.

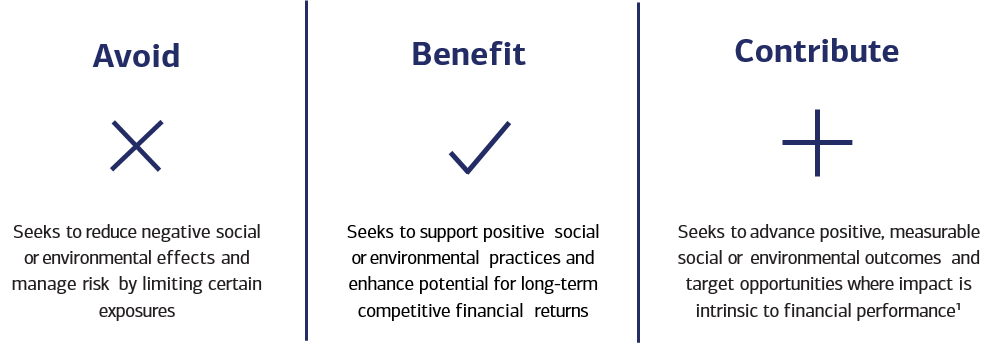

Impact investing is a subset of socially accountable investing (SRI). SRI is also referred to as sustainable or socially mindful investing. In some spheres, this sort of method is likewise called green investing. While the meaning of socially responsible investing incorporates avoidance of harm, impact investing actively looks for to make a favorable impact via its investments – Tysdal loans athletes sports.

For example, some investors may select not to buy business that make, distribute, or promote cigarettes due to the fact that of their general negative effect on individuals’s health (partner tivis capital). Numerous property management companies, banks, and other investment houses now use funds particularly tailored to socially responsible investors.

Although the company world has universally accepted tools for estimating a possible investment’s financial yields, no analogue exists for evaluating hoped-for social and environmental rewards in dollar terms. The Increase Fund and the Bridgespan Group have actually established an approach for approximating the financial worth of the social or environmental good produced by impact financial investments.

As concerns about deficiency and inequality become progressively urgent, many investors aspire to produce both organisation and social returns to “do well by doing great.” One opportunity is impact investing: directing capital to ventures that are anticipated to yield social and environmental advantages as well as revenues. But there’s a problem: Although the service world has actually a number of generally accepted tools, such as the internal rate of return, for approximating a possible investment’s monetary yields, no analogue exists for evaluating hoped-for social and environmental benefits in dollar terms.