Acupuncture helps in reducing stress, increasing blood flow to the reproductive organs, balancing the endocrine system and keeping the normal flow of this energy unblocked, thereby increasing a couple’s chances of conceiving.

Apr, 2020

Acupuncture helps in reducing stress, increasing blood flow to the reproductive organs, balancing the endocrine system and keeping the normal flow of this energy unblocked, thereby increasing a couple’s chances of conceiving.

Journeying through the bustling alleys and narrow streets of Seville, one can’t help but be struck by the vibrant energy and historical richness of Spain’s fourth largest city. Intricately weaved within the city’s urban fabric are some of the top hostels in Seville that promise to unfold a narrative of their own, adding depth to your travel experience. Offering much more than cost-effective accommodations, these hostels work as a gateway to a culturally immersive experience, where you get a chance to interact with locals, understand their ways of life, and create enriching memories according to https://travelmedia.biz/best-hostels-in-seville.

Each of these top hostels in Seville is unique, presenting a different facet of the city’s charm. Some are lodged in centuries-old buildings with sprawling courtyards and lush green rooftops, providing a serene oasis in the otherwise busy city landscapes. Others are situated in neighborhoods brimming with vibrant street art, cozy cafes, and pulsating bars, reflecting the city’s modernistic growth alongside its roots steeped in age-old traditions. These hostels serve not just as a place of stay, but as a lookout to explore and experience the city in its true essence. If you want to check out a few clubs when in Seville make sure to read this travelmedia.biz/best-clubs-in-seville article first.

Traveling solo has its unique set of challenges and rewards. One’s needs and preferences significantly shape their experience, and this is particularly true for solo travelers who have to rely on themselves for almost everything.

They hold a higher priority for safety, connectivity, and a welcoming social environment to interact with fellow travelers. Therefore, choosing the right accommodation becomes an imperative aspect in ensuring their journey is comfortable, enjoyable and enriching.

Among the various types of accommodation, hostels in Seville offer an appealing option for solo travelers. These hostels pay particular attention to the key requirements of solo travelers, striking a balance between affordability and comfort.

Moreover, they offer a chance to meet people from varied cultures and backgrounds, adding another layer to their travel experience. For solo travelers who seek social interaction whilst enjoying the charm of this Spanish city, the hostels in Seville might just be the perfect fit.

The magnetic pull of Seville’s budget accommodations is perhaps one of the city’s best-kept secrets. From the moment you step into the intimate, vibrantly decorated common areas replete with characteristic Andalusian art and decor, it is not hard to see why.

These budget accommodations, despite their affordability, comparably to their high-end counterparts, provide a unique immersive Spanish experience. Wiley backpackers tend to favor these locations for their comfort and affordability, invariably returning with tales of newfound friendships and enriching cultural exchanges.

However, it is not just the cozy home-like vibe that feeds into the allure of Seville’s budget accommodations. Another significant part of their charm is their strategic locations. Nestled in the heart of the city, many of these hostels are a stone’s throw away from important cultural sites and local hubs such as the Seville Cathedral, the Royal Alcazar, and the vibrant neighborhood of Triana.

For budget-conscious travelers who wish to soak in the essence of Seville with convenience and without causing a dent in their pockets, these budget accommodations hit the perfect sweet spot between comfort and affordability.

At the heart of Andalusia, Spain lies the vibrant city of Seville – renowned for its rich history, lively culture, flamenco music and dance. An overlooked but integral part of this charm, Seville’s hostels form a niche of their own, offering more than just budget-friendly accommodations to the global traveler.

Unique features of these hostels include their diverse architectural design, locally sourced artwork and interior decoration patterns that tell tales of the city’s profound past. Moreover, many Seville hostels are situated in gems of historic buildings, enriching their appeal with a fusion of ancient and modern aesthetics.

Each hostel presents a pocket of local culture, encouraging travelers to immerse in Seville’s life without having to step out. With open kitchens and common rooms, they provide social platforms to meet and interact with fellow adventurers.

Many organize in-house activities such as cooking classes and flamenco nights, enabling guests to experience the heart of Andalusian lifestyle. Front desks, typically operating around the clock, often go beyond their role, becoming informal travel guides suggesting off-beat local spots to explore. These unique offerings make Seville’s hostels far more than a place to rest – they are gateways to discovering the rich tapestry of Seville.

Delta-8 Tetrahydrocannabinol, commonly known as Delta-8 THC, has surged in popularity as a milder alternative to its more potent cousin, Delta-9 THC. However, its safety and regulatory status have sparked debates and concerns among health professionals and consumers alike. In light of recent warnings from authoritative sources like the FDA and CDC, it’s crucial to understand how much Delta-8 is safe for consumption.

Delta-8 THC is a cannabinoid found in cannabis plants, but it occurs in much smaller concentrations compared to Delta-9 THC, the primary psychoactive compound in marijuana. Because of its structural similarities to Delta-9 THC, Delta-8 also produces psychoactive effects, albeit milder. This subtlety has made it an attractive option for those seeking less intense experiences or therapeutic benefits without the strong high associated with traditional marijuana.

Despite its growing popularity, Delta-8 THC is not without its controversies. The FDA has issued warnings stating that Delta-8 THC products have not been evaluated or approved for safe use, highlighting that they may be marketed in ways that pose public health risks (FDA). Furthermore, research conducted by Hudalla’s lab found that 100% of nearly 5,000 Delta-8 samples tested were contaminated, some with up to 30 types of unintentional secondary substances ([WebMD](https://www.webmd.com/mental-health/addiction/news/20230906/delta-8-russian-roulette-of-cannabis)).

The allure of Delta-8 THC as a “milder” alternative does not exempt users from potential risks and side effects. Delta 8 reports that Delta-8 can still induce high states and may lead to undesirable or even dangerous side effects (Delta 8 reports). Additionally, there are specific dangers for children and pets, with available products like vape cartridges posing significant risks if ingested accidentally.

Given the current landscape, determining a “safe” amount of Delta-8 THC is challenging. The lack of comprehensive studies and standardized regulation means that product quality and potency can vary significantly between brands and batches. Until more research is conducted, and regulatory frameworks are established, consumers should approach Delta-8 THC with caution.

As the conversation around Delta-8 THC continues to evolve, so too will our understanding of its safety profile. With current evidence pointing towards significant variability in product safety and potency, consumers must navigate this landscape with vigilance and informed caution. Ultimately, fostering a safer environment for Delta-8 THC consumption will require concerted efforts from researchers, regulators, manufacturers, and consumers alike.

In Adelaide, South Australia, the field of speech therapy plays a vital role in supporting individuals of all ages to overcome communication challenges. From children with developmental delays to adults recovering from strokes, speech therapists, also known as speech-language pathologists, employ various techniques and interventions to improve speech, language, and overall communication skills. This article explores the significance of speech therapy in Adelaide, highlighting its impact on individuals and the community at large.

The Importance of Speech Therapy:

Speech therapy addresses a wide range of communication disorders, including articulation difficulties, language delays, fluency disorders (such as stuttering), voice disorders, and swallowing difficulties. In Adelaide, speech therapists work collaboratively with clients, their families, and other healthcare professionals to assess, diagnose, and develop personalized treatment plans tailored to each individual’s needs.

For children, early intervention is crucial in addressing speech and language delays. Speech therapists in Adelaide often work with pediatric clients to enhance their communication skills, supporting their academic, social, and emotional development. Through structured therapy sessions, children learn to articulate sounds, expand their vocabulary, and improve their ability to express themselves effectively.

In the adult population, speech therapy is instrumental in aiding individuals recovering from neurological conditions such as strokes, traumatic brain injuries, or degenerative diseases like Parkinson’s. These conditions can significantly impact speech, language, and swallowing functions. Speech therapists employ specialized techniques to help adults regain speech clarity, language comprehension, and swallowing abilities, thereby improving their quality of life and facilitating their reintegration into daily activities.

Tailored Approach to Therapy:

One of the strengths of speech therapy in Adelaide lies in its personalized approach to treatment. Speech therapists assess each client’s unique strengths, challenges, and communication goals before designing individualized therapy plans. These plans often incorporate a combination of techniques, exercises, and strategies aimed at addressing specific communication needs.

For example, for children with speech sound disorders, therapists may use play-based activities, phonological awareness exercises, and articulation drills to target speech sound production. In contrast, adults with aphasia, a language disorder often resulting from stroke, may engage in language stimulation activities, cognitive-linguistic exercises, and augmentative communication strategies to improve their language skills and functional communication abilities.

In addition to direct therapy sessions, speech therapists in Adelaide also provide valuable education and support to clients’ families and caregivers. They offer guidance on facilitating communication at home, implementing strategies to support speech and language development, and understanding the communication needs of their loved ones. This collaborative approach empowers families to play an active role in their loved one’s progress and enhances the effectiveness of therapy beyond the clinical setting.

Integration of Technology:

Advancements in technology have revolutionized the field of speech therapy, providing therapists in Adelaide with innovative tools and resources to enhance treatment outcomes. Speech therapy apps, computer-based programs, and digital communication devices have become valuable adjuncts to traditional therapy approaches, allowing clients to practice skills, receive immediate feedback, and track their progress remotely.

Moreover, telepractice, which involves delivering speech therapy services remotely via video conferencing platforms, has become increasingly prevalent in Adelaide, particularly in rural or underserved areas where access to in-person therapy may be limited. Telepractice enables clients to receive high-quality therapy services from the comfort of their homes while maintaining regular communication with their therapists.

Challenges and Opportunities:

Despite the significant benefits of speech therapy in Adelaide, several challenges persist, including limited funding for therapy services, long waitlists for public healthcare, and disparities in access to specialized care, particularly in regional areas. Addressing these challenges requires continued advocacy for increased funding and resources, as well as innovative approaches to service delivery and community outreach.

However, amidst these challenges lie opportunities for growth and collaboration within the speech therapy community in Adelaide. Through interdisciplinary collaboration with healthcare professionals, educators, and community organizations, speech therapists can expand their reach, promote early intervention initiatives, and raise awareness about the importance of communication disorders.

In Adelaide, speech therapy serves as a cornerstone in supporting individuals of all ages to overcome communication challenges and achieve their full potential. Through personalized treatment approaches, integration of technology, and collaboration with families and healthcare professionals, speech therapists empower clients to enhance their communication skills, foster meaningful connections, and navigate the complexities of everyday life with confidence. As the field continues to evolve, the impact of speech therapy in Adelaide will undoubtedly remain profound, enriching the lives of individuals and strengthening the fabric of the community.

Los Angeles, with its sprawling urban landscape and vibrant motorcycle culture, sees countless enthusiasts buying and selling motorcycles across the city and beyond. However, when it comes to transporting these prized possessions, finding an affordable and reliable shipping service becomes paramount. This review delves into the landscape of Cheap Motorcycle Shipping Los Angeles options in Los Angeles, providing insights into some of the top-rated services and considerations for bikers.

Before diving into specific shipping options, it’s essential to understand the key factors that influence the choice of a shipping service:

Finding a cheap motorcycle shipping service in Los Angeles requires careful consideration of cost, reliability, insurance, and customer reviews. While several options are available, services like Ship a Car Direct, Montway Auto Transport, and UShip stand out for their affordability, reliability, and positive customer feedback. Additionally, considering local providers and weighing the benefits of DIY shipping versus professional services can help bikers make informed decisions tailored to their needs and budgets. By prioritizing these factors, motorcycle enthusiasts can ensure a smooth and hassle-free shipping experience for their prized possessions.

Cheap Motorcycle Shipping Los Angeles

10250 Santa Monica Blvd #29, Los Angeles, CA 90067

12137129181

Medical centres are establishments that offer various health-care services. You’ll find them everywhere from hospitals and universities to private practices offering low cost or free care.

HIPAA prohibits regulated entities from disclosing individual protected health information to media without written permission of either them or their representative, making Maimonides Medical centre subject to this rule.

Types

There are various types of Stirling-Clinic medical center Adelaide Hills, each offering its own services. Hospitals, health centres, and specialty facilities are the three primary types. Staffed with doctors, nurses, medical assistants, other healthcare professionals as well as equipped with X-ray machines and other diagnostic tools are present at these facilities – some are located in rural areas while others can be found in cities.

Hospitals serve as the cornerstone of healthcare delivery, treating even the most serious illnesses and injuries. Hospitals typically feature intensive and non-intensive care units; intensive care units typically treat those facing life-threatening conditions, while non-intensive units provide childbirth and surgery care services.

Many hospitals are owned by the government, while there are also private and for-profit hospitals. Some hospitals affiliated with medical schools provide education opportunities to future physicians while providing community services and acting as incubators for innovation and technology in medicine.

Locations

Locating a medical centre properly is key to its success. Patients and doctors alike must easily be able to reach it, providing comfortable environment as well as providing state of art technologies. Consultation with experts for all required permits like fire safety certification is vital as well.

The Washington University Medical Campus covers 17 city blocks on 164 acres. It includes Barnes-Jewish Hospital, St. Louis Children’s Hospital and its School of Medicine; physicians here receive a flat salary that reduces any potential financial incentives to see more patients.

The University of Rochester Medical centre campus houses regional prenatal centres, trauma centres, burn centres and James P. Wilmot Cancer centre as well as an AIDS Treatment centre – making it the largest medical complex in the world and at the forefront of advancing life sciences. Furthermore, this vibrant Stirling-Clinic medical center Adelaide Hills environment promotes cross-institutional collaboration, creativity and innovation – key characteristics for sustainable success in medical fields today.

Services

Medical centres are facilities that offer various healthcare services. Their staff is professionally trained to deliver top quality care while being aware of potential risks that need mitigating. If you’re planning on opening one yourself, be sure to research state regulations first before making your decision.

Additionally, medical centres located nearby universities often benefit from being in proximity; this allows them to draw top talent more easily and collaborate more closely on innovative solutions that improve patients’ treatments more rapidly.

Preventive care can also play an integral part in improving patient health, such as regular physicals, vaccinations, and screening for diseases such as cancer. Doctors may suggest lifestyle changes or medications. Furthermore, non-emergency symptoms like coughs or sore throats may also be treated through non-emergency services, like free flu shots or blood work at medical centres offering convenient yet cost-effective medical solutions such as these.

Costs

Many factors impact the cost of hospital services. For instance, the price of a CT scan depends on whether it includes contrast agent to make blood vessels and organs more visible; and an outpatient colonoscopy procedure’s price depends on its location as well as whether the patient has insurance.

Labor costs make up a large share of hospital expenses, since hospitals must invest significant resources in recruiting and retaining staff as well as payroll and benefit costs. Labor costs are highly sensitive to pricing: routine services may often be priced below expenses to generate profits through additional ancillary services that bring patients into hospital (e.g. diagnostic tests). For more information about Stirling-Clinic medical center Adelaide Hills, click here.

Studies that attempt to control for size and case mix indicate that investor-owned hospitals tend to incur higher expenses than not-for-profit institutions, though variance in how overhead costs are distributed among departments may make comparing expenses between hospitals of various ownership types difficult.

Orthotics are designed to absorb shock, improve balance, and relieve pressure off of the foot. Constructed using various materials ranging from plastics such as polypropylene and graphite to soft cushioning materials like neoprene for ultimate cushioning effects, orthotics can provide cushioned relief in many different situations.

Custom insoles may be expensive, but their benefits usually make up for their expense. This article will explore all the factors contributing to how much is orthotics Adelaide.

Cost

Custom orthotics may not come cheaply, but they can offer long-term relief from foot and ankle discomfort. Furthermore, custom orthotics are an invaluable investment for active individuals; potentially saving thousands in medical expenses in the future.

Over-the-counter shoe inserts may be purchased without needing to see a doctor, but they are unlikely to address your foot and ankle pain issues. Common materials used for these inserts include foam and plastic; over time these materials could rub against your feet and lead to further discomfort.

Many podiatrists provide custom orthotics to patients, which may take two weeks. The process typically includes an examination of lower extremities including X-rays and treadmill gait test; plaster cast of foot/ankle may also be made during this time (plaster casting). Custom orthotics may or may not be covered under your insurance plan, though you may use flexible spending accounts as payment for them if applicable.

Materials

Material used to craft an orthotic is key, as its flexibility and cushioning capabilities will determine its effectiveness. Stiffer materials could limit your shoe choices or movement capabilities; for this reason, it is crucial that patients communicate their preferences to their physician regarding what their orthotic should accomplish.

Rohadur or Polydur rigid plastics were some of the earliest manmade materials used for orthotics, though their crack-prone nature makes them unsuitable for everyday use. Carbon-based materials, like Carboplast or graphite are now being utilised to produce thin functional orthotics as they offer greater strength, lighter weight, and thinner dimensions than acrylic plastics.

The top cover is the part of the device that contacts the foot and can be constructed from various fabrics (marine-grade fabrics with anti-fungal additives or perforated polyethylene foam are among options available), offering soft yet stable support for users’ feet. To know about how much is orthotics Adelaide, click here.

Prescription

If you are suffering from foot ailments, visiting your physician could result in receiving a prescription for orthotics – medical devices placed inside shoes to correct biomechanical issues like poor posture and overpronation of feet. As opposed to over-the-counter shoe inserts, prescription orthotics are tailored specifically to each individual and manufactured according to his or her specifications.

These shoe inserts are constructed from medical-grade foam and can be expected to last multiple years with proper care. Athletes also find them beneficial, as they help distribute body weight more evenly and thus lower risk of injury.

Orthotics can be purchased at ski shops, shoe stores and sporting goods stores; however, it’s best to consult a podiatrist or foot specialist prior to purchasing any device to ensure the device fits appropriately and provides maximum benefits. Custom orthotics are often covered under medical insurance policies.

Turnaround time

Orthotics are shoe inserts designed to rebalance foot weight. Orthotics may help relieve pain, increase endurance, and improve foot posture for people suffering from various problems; additionally, orthotics can reduce pressure on ligaments and joints of the foot.

People looking to maximise comfort and performance will need custom-made orthotics. While this form of support may be more expensive and not covered by health insurance plans, they can make a dramatic difference in someone’s life. To know about how much is orthotics Adelaide, click here.

Orthotics typically last two years with proper maintenance, though it should be replaced sooner if they begin showing signs of wear and tear or no longer provide optimal balance. Regular follow-up and assessments can help people determine when it’s time to replace their orthotics; those who wear theirs for extended periods or are extremely active will likely need new ones more frequently than average.

Confused about the choice between an assisted living facility and a nursing home for a family member? This comprehensive guide on ‘assisted living facility vs nursing home‘ will help you understand the key differences and make the right decision for your loved one’s unique needs.

When it comes to senior care, one of the most significant decisions families face is choosing between an assisted living facility and a nursing home. Understanding the differences between these two options is crucial in determining the best fit for your loved one’s needs. This article will explore the ‘assisted living facility vs nursing home’ debate, highlighting key differences, benefits, and factors to consider.

An assisted living facility is a residential option for seniors who need help with some daily activities but do not require the intensive medical and nursing care provided in a nursing home. These facilities offer a balance of independence and assistance, providing services like meal preparation, housekeeping, and medication management.

A nursing home, also known as a skilled nursing facility, provides a higher level of medical care than an assisted living facility. It’s designed for individuals who require 24-hour supervision and medical assistance. Nursing homes offer extensive care, including full-time nursing staff, physical therapy, and specialized medical care.

Deciding between an ‘assisted living facility vs nursing home’ is a complex process that depends on individual health needs, financial considerations, and personal preferences. By understanding the differences and carefully evaluating your options, you can make an informed decision that ensures the best care and quality of life for your loved one.

Changing hearing aid batteries on an ongoing basis may be challenging for those with dexterity issues, and small batteries can pose a danger to children and animals who might accidentally consume them.

Rechargeable hearing aids Adelaide eliminate this hassle by eliminating the need to buy, switch out and dispose of disposable batteries – although some patients may find the additional cost prohibitive.

Long-Lasting

Rechargeable hearing aids Adelaide offer many advantages over disposable batteries, including extended battery life and easy opening for replacement if required. Many models can go a full day before needing charging, eliminating the need to purchase and carry extra backup batteries, which might run out unexpectedly. This feature can especially assist those with mobility or motor control issues who find opening their hearing aid battery compartment difficult.

Rechargeable batteries also reduce the number of small button-sized batteries lying around that could pose a choking hazard to children by being charged overnight in a safe place like a charging case and then stored away when not needed. It also helps decrease wasteful battery use in landfills while relieving wearers from having to remember to bring out and change batteries every few days.

Environmentally Friendly

Many new rechargeable hearing aid options feature sealed lithium-ion batteries to ensure maximum safety and performance, protecting kids, pets, and those with dexterity issues who find opening smaller battery doors on older hearing aid models difficult. Furthermore, sealed batteries offer better moisture, dirt and debris protection for hearing aids.

Lithium-ion cells offer significant environmental advantages over their predecessor, silver metal zinc-air batteries. Their rechargeable nature reduces their environmental footprint compared to disposable batteries, which typically only get used once before being thrown out in the trash.

If you’re curious to experience rechargeable hearing aids, visit one of our partner offices and see the Starkey Genesis AI or Evolv AI models first-hand. Our hearing specialists are on hand to answer any queries and help determine whether these devices suit your lifestyle needs.

Safety

Lithium-ion rechargeable batteries offer significant environmental advantages compared to zinc-air disposables that must be constantly renewed, with thousands of recharges before being safely recycled into landfills. It is far preferable.

Rechargeable batteries also do not present a health hazard to children and animals, unlike small disposable batteries, which could be swallowed and cause significant health risks for infants, toddlers and animals. Hearing aids with rechargeable batteries do not need to be removed regularly but can be docked overnight instead of routinely removed from wearers’ ears.

Rechargeable options also offer greater reliability because many do not feature battery doors that could allow moisture, dust, or debris into their internal components and corrupt their functioning. If you’re considering purchasing one that uses rechargeable batteries, we advise speaking to one of our audiologists to learn about your options and find one best suited to your lifestyle based on manufacturer availability. However, the FDA has approved rechargeable models suitable for in-the-ear (ITE), in-the-canal (ITC), receiver-in-canal (RIC), and behind-the-ear (BTE). They are easy to use, long-lasting, and environmentally friendly!

Convenience

Small disposable batteries can be challenging for people with limited dexterity (for instance, those suffering from arthritis or health conditions that cause tremors). Furthermore, their small size increases the risk of accidental ingestion – but rechargeable hearing aids eliminate this concern with built-in lithium-ion batteries that do not require frequent replacement.

Rechargeable hearing aids Adelaide make life simpler: plug them in at night and go about your day without ever needing an extra battery – eliminating the risk of misplacing or losing them altogether and dissuading some from wearing hearing aids altogether.

One fully charged battery can last up to 19 hours of playback time, providing ample listening time when it counts most and saving both waste and cost associated with replacing batteries every few days or weeks.

Many hearing aids on the market use replaceable batteries. Some have a small battery door that is easy to open and close for those with dexterity issues. However, others require a user to pull out the old battery and put in a new one. It can be difficult for people with arthritis or dexterity issues. It can also be a turnoff for people who aren’t interested in carrying around extra batteries in case they lose or accidentally misplace their hearing aids. That is why rechargeable hearing aids are becoming increasingly popular.

In the world of household repairs and maintenance, the sensible role of a handyman is usually ignored. Nonetheless, these competent professionals play an important role in preserving the problem of our homes. This post will certainly explore the realm of handyman services, describing their advantages and explaining why they are a necessary asset for homeowners.

Handymen use a different selection of services, making them the superb choice for a selection of house requirements. Below are a couple of instances of the regular jobs handymen can execute:

Increase Your Home’s Allure: Purchasing handyman solutions can substantially enhance your home’s value when you prepare to market. A well-maintained building is not simply extra attracting feasible buyers, nevertheless it in addition mirrors favorably on the vendor’s focus to info and dedication to maintenance. By solving repairs and enhancements, you can produce a more desirable home that manages a greater price tag.

In order to absolutely boost the advantages of handyman services, it is important to find the suitable specialist that fits your needs. Below are a couple of ideas for selecting the exceptional handyman:

To conclude, handyman options are a beneficial source for homeowners, offering comfort, versatility, and affordable services for various house tasks. Whether you call for fixing services, maintenance, or home restoration work, a seasoned handyman can help maintain your home in exceptional condition and preserve you time and money in the future.

Electronic Fund Transfer (EFT) has ended up being a basic element of modern-day monetary purchases. In Canada, the adoption of EFT services has actually substantially simplified the means individuals and companies handle their financial resources. This short article delves into the advantages of Canada EFT, highlighting the positive impact it carries the nation’s monetary landscape.

EFT in Canada, also referred to as Electronic Funds Transfer, is a technique that enables the electronic movement of funds in between bank accounts. This system supplies a secure, reliable, and convenient solution for transferring, getting, and managing finances, eliminating the requirement for physical checks or cash exchanges.

The introduction of Canada EFT has actually noticeably altered the economic surface, extending many advantages, including boosted performance, decreased expenditures, and boosted security, to both organizations and people. Its capacity for real-time reporting, simplicity of use, and flexibility have revolutionized the fashion in which financial transactions are performed, simplifying monetary management and advertising a lasting method to economic dealings.

Finally, Canada EFT is a transformative force in the world of financing, supplying rate, effectiveness, security, and cost savings for organizations and individuals. As technology continues to development, Canada EFT is expected to play a significantly substantial function in shaping the future of electronic payments, offering a safe and effective methods of carrying out monetary purchases in an ever-evolving globe.

Massage chairs, for many, are synonymous with luxury and relaxation. Yet, there’s more to the story. Delve into the world of how massage chairs work, aligning the art of relaxation with the science of health benefits.

To truly grasp the benefits of massage chairs, one must first understand the body’s response to massage.

Modern chairs come equipped with techniques that target deep muscle tissues.

One often overlooked benefit is the chair’s impact on the lymphatic system.

Massage chairs today often incorporate stretching programs, aiding in joint health and flexibility.

Recent innovations have expanded the potential health benefits of massage chairs.

The psychological benefits of a massage chair session are just as critical.

While individual benefits are pronounced, there’s a broader health context to consider.

The fusion of art and science in massage chairs offers a holistic approach to health. Far beyond mere relaxation, these chairs work in harmony with our bodies, promoting both physical and mental well-being. As technology continues to evolve, so will the ways we harness it for health, ensuring that massage chairs remain at the forefront of wellness innovation.

When searching for an Invisalign provider, be sure to choose one who possesses both experience and expertise in real-life cases as well as a positive reputation.

Your Invisalign specialist dentist Hendon will perform an initial screening to make sure you are an ideal candidate for clear aligners treatment, then send them off to be customised and manufactured by a lab.

How Invisalign Works

Dentists specialising in Invisalign will take three-dimensional digital images of your jaw before creating an individual treatment plan using ClinCheck software to move individual teeth on screen and observe how straightening affects facial aesthetics.

As opposed to traditional braces, Invisalign trays are transparent and easily removable for meals and brushing teeth. Furthermore, they’re tailored specifically to each patient’s mouth and gumline to allow for an uninterrupted eating experience without being limited by hard or sticky foods.

Trays may also be less likely to produce food debris or plaque build-up than metal braces due to lack of wires and brackets that trap bits of food debris, yet patients must still be sure to brush and floss regularly, particularly because cleaning the trays is challenging.

Some Invisalign patients may require an IPR (interproximal reduction). This procedure entails having their dentist sand down some enamel from their patient, creating space between teeth so that Invisalign treatment will proceed more easily.

Invisalign Treatment

Invisalign specialist dentist Hendon can address a range of dental issues, from crookedness and crowding to bite issues and TMJ dysfunction. Correcting them with Invisalign not only makes your smile more appealing but can help avoid future health problems like tooth decay, gum disease and TMJ dysfunction.

Invisalign treatment is less invasive than traditional braces. Instead of metal wires and brackets, Invisalign uses clear trays that blend seamlessly with your smile instead. Made of Invisalign’s own patented material called SmartTrack, they can be customised-fitted specifically to your mouth for ultimate comfort and can easily be cared for with warm water mixed with hydrogen peroxide for cleaning; most cases typically require 20-30 trays; they’re changed every one to two weeks.

At least once every six to eight weeks, you should visit an Invisalign-trained dentist for progress checks. They will evaluate your teeth and gums to ensure the aligners are functioning as designed, providing new trays as necessary and discussing any concerns you have about Invisalign treatment.

Similar to mail-in teeth-straightening products, appointments for Invisalign are an integral part of its process. Missing them could delay or even stop its effectiveness; Invisalign works best when used by adults; it may not work as effectively for teens and younger children.

Invisalign Cost

Costs associated with Invisalign will differ based on a number of factors, but one key element to keep in mind is whether or not your dental insurance covers some or all of it. Most dental plans offer orthodontic benefits which cover Invisalign costs in addition to braces – and sometimes cover them both! Coverage amounts for Invisalign specialist dentist Hendon may be measured either as a percentage or set dollar amount with most plans having lifetime caps for such benefits.

On the Invisalign website, you can locate certified Invisalign providers. These orthodontists have been pre-vetted by the company to ensure they possess appropriate training and experience, and selecting an orthodontist who holds this title can help prevent overpaying for treatment while guaranteeing more effective results.

Invisalign Insurance

Most dental insurance plans cover orthodontic treatments like Invisalign; however, it’s essential to review your specific policy to confirm coverage. Orthodontic benefits typically cover up to $1,500 of treatment costs; comprehensive dental policies often include this benefit; alternatively you can check with your orthodontist’s office and see if they are an approved Invisalign provider.

The cost of Invisalign may depend on your dentist or orthodontist’s qualifications and the complexity of your case, with traditional metal braces using brackets and wires which remain fixed in place throughout treatment while Invisalign uses clear aligners that can be taken out for oral hygiene, meals, or special events – usually within 12-18 months to straighten crookedness in teeth.

Finding an Invisalign specialist dentist Hendon who specialises in treating various conditions can save money on treatment. Ask if they offer monthly payment plans; these make large expenses more manageable by breaking them down into manageable chunks over time.

As well, visiting your regular general dentist to receive Invisalign may also be beneficial, since they will have records of any previous tooth cleanings or work performed – making follow-up appointments and assistance easier if required.

Senior living in El Cajon is rapidly gaining attention for its harmonious blend of comfort, community, and care. Nestled amidst the picturesque landscapes of Southern California, El Cajon offers seniors a tranquil environment complemented by state-of-the-art amenities and compassionate care services. But what makes El Cajon stand out from the rest? Let’s delve into what makes El Cajon the preferred choice for many seniors and how you can make the most of your golden years in this serene city.

El Cajon, with its temperate climate and scenic beauty, is a haven for those looking to relax and rejuvenate. Surrounded by mountains and blessed with sunny days, the city provides a peaceful backdrop for seniors to enjoy their days, whether it’s taking a walk in a park or simply relaxing in their residence.

The city is home to some of the most modern senior living communities. These residences offer everything from independent living apartments to assisted living and memory care facilities. With amenities like swimming pools, fitness centers, and gourmet dining, seniors in El Cajon live in the lap of luxury.

One of the standout features of senior living in El Cajon is the emphasis on community. Regular events, workshops, and social gatherings are organized to ensure that seniors stay connected and engaged. Whether it’s art classes, book clubs, or musical nights, there’s always something happening to keep the community vibrant.

The elderly care services in El Cajon are top-notch. With a team of dedicated professionals, the senior living communities ensure that every resident receives personalized care. From medical assistance to daily activities support, the staff is trained to cater to the unique needs of every individual.

El Cajon’s strategic location ensures that seniors have easy access to essential services. From top-tier medical facilities to shopping centers, everything is within reach. Additionally, the city’s efficient transportation system makes it easy for seniors to move around without any hassle.

At the heart of El Cajon’s senior living experience is a culture of respect. The communities here thrive on mutual understanding and camaraderie. Seniors are not just residents; they are valued members of a larger family, ensuring that every individual feels at home.

Choosing a place for senior living is a significant decision, and El Cajon undoubtedly stands out as an excellent choice. With its perfect blend of comfort and community, seniors can look forward to a fulfilling and enriching life in this beautiful city. If you’re considering senior living options, El Cajon should undoubtedly be on your list.

Thinking about senior living in El Cajon? Dive into the unique blend of comfort and community this city offers for the elderly. Don’t miss out!

Invisible hearing aids can be an ideal choice for many. Being smaller than their counterparts and fitting deep inside your ear canal means they won’t get caught on clothing like scarves and hats – which might otherwise get in their way.

Invisible hearing aids Adelaide offer several distinct advantages over their traditional counterparts: no impression of your ear is required for fitting them immediately, making them much more compact and portable.

More Natural Hearing

Invisible hearing aids are specifically designed to fit deep inside the ear canal and work in synergy with your natural resonant frequency for a more natural sound quality. Plus, they’re lightweight, small and won’t get caught on clothing like scarves.

Small hearing aids require less power to transmit sound, leading to reduced whistling sounds and feedback. Meanwhile, larger hearing aids often use more power and may cause acoustic feedback when used for phone calls or in noisy environments.

if you are considering invisible hearing aids, we advise speaking to a HHP about your individual requirements and types of sounds that you need to hear. They will assist in selecting an option that is most suitable to your circumstances.

There are various styles of invisible hearing aids, ranging from CIC (Completely In The Canal) models to IIC styles. Your ear canal size and shape will determine which option is most suitable.

Phonak Lyric hearing aids offer the latest in invisible hearing technology, selling as an annual subscription plan and placed discreetly into your ear canal by your hearing professional for all-day wear – showering, exercising, sleeping and all daily life tasks are no match for them! With their discreet design and high-quality audio processing technology found across other Phonak products.

Good for an Active Lifestyle

f you live a busy lifestyle, invisible hearing aids Adelaide may be the ideal solution for you. These devices are specifically designed to be comfortable enough for long wear without hindering your lifestyle or getting in the way. Furthermore, their snug design means they produce clear and natural audio quality; wind noise won’t interfere with their sound output either!

Invisible hearing aids tend to be more secure in the ear canal than other styles and are therefore less likely to fall out, making them especially helpful for outdoor and windy environments. Unfortunately, invisible hearing aids might not be appropriate for individuals with sensitive ear canals or irregularly shaped canals and should generally not be worn if suffering from conditions like dermatitis or otitis externa.

HC Audiology stands out as a leader among manufacturers producing custom-moulded invisible devices, winning many awards and becoming known for features like fitness tracking and virtual assistant capabilities. Furthermore, they support the Starkey Hearing Fund which donates one of their smallest invisible hearing aids directly to developing nations for every device sold by Starkey.

Shorter Battery Life

Many invisible hearing aids run on non-rechargeable batteries that must be purchased constantly to operate, creating an inconvenience for people looking for discreet devices without constantly buying new batteries. Some manufacturers now offer rechargeable hearing aids as an option.

These devices work by vibrating the ear canal to produce sound that is amplified by an internal microphone and sent directly to the ear drum via the canal. Unfortunately, however, due to their compact size, they may not provide sufficient amplification for those suffering severe hearing loss and do not have enough room to incorporate advanced features like Bluetooth streaming.

MDHearing provides small, rechargeable invisible hearing aids Adelaide suitable for active individuals with moderate to severe hearing loss. Their devices offer risk-free trial periods and can be purchased online.

Phonak, a subsidiary of Sonova and one of the world’s largest hearing aid manufacturers. Their product, Lyric, is widely considered one of the more discreet invisibly hearing aids on the market; designed for 24/7 wear in an ear canal like contact lenses and featuring soft biocompatible material for optimal comfort, Lyric can stay put even during showering or exercising sessions!

You Don’t Like the Feel of Something in Your Ear Canal

Many individuals who want to wear hearing aids are embarrassed about how they look; this has long been an impediment, but advances in technology now make it possible to enjoy all the advantages without feeling self-conscious about wearing hearing aids.

Invisible hearing aids are discreet, meaning they won’t interfere with your normal activities or stand out. Instead, they sit comfortably deep within your ear canal and can only be seen when someone peers into your ear canal. Some invisible hearing aids such as Signia Pure Nx IIC don’t require an impression to ensure they fit comfortably, while Oticon Own and Phonak Lyric require one to provide an optimal fit.

Hearing aids should be tailored specifically to you based on factors like hearing loss type and canal shape as well as personal preferences and lifestyle factors. To find out more about which invisible hearing aids may benefit you, book an appointment with a hearing care professional – they will evaluate your case and recommend the ideal style of aid based on individual requirements.

In the heart of Michigan lies Gaylord, an Alpine Village that does more than just showcase Mother Nature’s artwork. Beyond the vast lakes and dense forests, the cultural fabric of Gaylord, MI tells tales of traditions, arts, and culinary delights. Are you ready to tune into Gaylord’s cultural rhythm?

Gaylord’s moniker as the “Alpine Village” isn’t merely a nod to its scenic beauty; it reflects its rich Alpine roots. The town planners, inspired by European Alpine architecture, envisioned a community that paid homage to these traditions. As a result, Gaylord’s buildings, with their unique chalet-style designs, echo the Swiss Alps’ aesthetics. This alpine influence is evident not just in architecture but also in the city’s traditions, from folk dances to alpine music fests that harken back to its European ancestry.

Gaylord’s calendar is dotted with festivals that celebrate its unique Alpine heritage. The Alpenfest, for instance, is a yearly event that attracts thousands, offering five days of music, food, and parades. Then there’s the Winterfest, which brings the cold streets alive with ice sculptures, sledding, and the much-anticipated Polar Plunge. These events, coupled with smaller, more intimate gatherings, ensure that the spirit of celebration is ever-present in Gaylord.

One of Gaylord’s quirkier attractions is the enchanting Fairy Trails. Winding through forests and meadows, these trails are dotted with gnome homes and fairy dwellings. Crafted meticulously by local artists and families, these miniature homes—built into tree trunks and hidden under roots—offer a whimsical exploration experience. Children and adults alike are often seen penning letters to these magical forest inhabitants, making the Fairy Trails an interactive cultural journey.

A dive into Gaylord’s culture would be incomplete without savoring its culinary offerings. Rooted in Alpine traditions, many local dishes showcase hearty flavors and rich textures. From traditional sausages and cheeses to more contemporary fusion dishes, Gaylord’s restaurants offer a delightful gastronomic journey. Special mention must be made of the town’s bakeries, which churn out Alpine-inspired pastries and bread that are nothing short of heavenly. Paired with local brews or wines, Gaylord’s cuisine tells tales of traditions passed down through generations.

Walk through any market in Gaylord, and you’ll be greeted by stalls showcasing the craftsmanship of local artists. Handcrafted wooden toys that hark back to Alpine traditions, intricately designed jewelry, handwoven fabrics, and more—Gaylord’s local artisans keep the town’s cultural legacy alive through their creations. Numerous workshops and events also allow visitors to learn these crafts, making for a hands-on cultural experience.

Gaylord, often recognized for its natural splendors, also stands as a testament to the rich tapestry of traditions, art, and culinary wonders that its residents cherish. In every bite of its local dishes, in every note of its traditional songs, and in every craft its artisans produce, Gaylord’s cultural heart beats strong. So, when you next tread its trails or sail its lakes, take a moment to delve deeper into its stories—they’re bound to captivate and inspire.

Occupational Therapy for Autism Adelaide is a new world-first facility for adolescents with Autism Spectrum Disorder (ASD). Located in Mile End South, this purpose-built clinic is an extension of OTFC+, which focuses on children’s physical, social and sensory needs.

OT practitioners use cognitive behavioural approaches focusing on changes in cognition or how people think. This can improve attention and self-regulation skills in individuals with ASD.

Social skills

Interacting socially with others and maintaining relationships is essential for human well-being. It is a learned ability and is referred to as social competence. Occupational Therapy (OT) helps individuals improve their social skills through therapeutic activities and techniques. These skills can include communication, emotional regulation, friendship-making and problem-solving. OTs also focus on understanding and responding to sensory input from other people. This includes body awareness, visual perception, listening, and verbal and nonverbal communication.

People with autism can experience difficulties in various social situations, including conversations and interactions. These challenges may affect their ability to form and sustain relationships, leading to depression and anxiety. If left untreated, these issues can hurt school and career opportunities. OTs use a range of approaches and tools to help improve the abilities of children with autism and their families.

In addition to improving social skills, OTs can teach self-care and independence skills. These skills are essential for a child’s daily life, including mealtime, bathing, and toileting, dressing and grooming, and sleeping. They can also learn to engage in leisure activities and develop motor skills. OTs can teach these skills to children one-to-one or in group therapy settings.

The first step in improving social skills is identifying areas where a person has difficulty. This can be as simple as placing their struggles with eye contact, or they may struggle to start a conversation. Once the problem has been identified, a plan can be created to address the issue. This plan may involve role play and activities that help to practice the new skill.

Occupational therapy for autism Adelaide services is available in private and public health care. In addition, they can be included in an Individual Education Program at school.

Sensory processing

Processing sensory information is vital for learning and interacting with the environment. This is why sensory processing can be a crucial focus for occupational Therapy for autism in Adelaide. The sensory system involves the senses of touch, movement, taste, smell, light and sound. People with autism often have difficulty processing these senses, leading to challenging behaviour and self-regulation problems. Sensory processing also plays a role in social interactions and emotional regulation. These issues can affect a child’s daily functioning and independence in the community.

OTFC+ offers services that can help children and adults with sensory processing difficulties. These include the LIFEskills group program and the SOCIALskills group program, which teach the skills needed for daily living. These include food preparation, money handling, home organisation and safety in the community. The program is designed to improve a person’s quality of life and encourages independence.

Sensory integration is the ability to combine all of these systems into a coordinated and adaptive response. This is a critical component of occupational therapy for autism Adelaide, as it allows a person to participate in their environment and function at their best. Occupational therapists use fun activities to enable clients to experience stimuli without becoming overwhelmed. These coping strategies can be taught to the parents and carers of the client, who can then apply them to everyday situations. For example, a child with sensory processing difficulties may be able to cope in a classroom by using the desk chair bungee cord to wiggle their legs.

The results of this study suggest that sensory processing assessment tools such as The Sensory Form can help identify and target areas for intervention. The therapists’ feedback highlighted the device’s strengths, including the ease of use and clarity of the language used. It was also helpful for therapists to engage in professional reasoning when designing their interventions. These tools can help demonstrate the effectiveness of their interventions to insurance companies and others involved in providing funding.

Self-care skills

Children with autism face many challenges when learning basic life skills such as bathing, eating and self-care. They can be easily overwhelmed by stimuli in their environment and have difficulty focusing and following instructions. They may also be prone to emotional outbursts. This is why it is essential to seek your child’s help from an occupational therapist as early as possible.

Introduction

In the world of fitness and bodybuilding, athletes are continuously on the lookout for safe and effective supplements that can help them achieve their performance and physique goals. One such class of compounds that has gained popularity is Selective Androgen Receptor Modulators (SARMs). Among them, RAD-140 Testolone has emerged as a promising option for those seeking muscle gains and strength improvements. In this article, we will explore the potential benefits and risks of RAD-140 as a SARM, shedding light on its mechanism of action and its impact on the body.

Understanding RAD-140 Testolone

RAD-140, also known as Testolone, is a non-steroidal SARM developed to treat muscle wasting conditions and osteoporosis. Unlike anabolic steroids, SARMs are designed to target specific androgen receptors in the body, promoting muscle growth while minimizing unwanted side effects on other tissues, such as the prostate or liver. RAD-140 is praised for its high anabolic activity and its ability to provide results similar to anabolic steroids without the same level of androgenic effects.

The Mechanism of Action

RAD-140 binds to androgen receptors in skeletal muscle and bone tissue, stimulating anabolic activity and protein synthesis. By targeting these specific receptors, RAD-140 encourages muscle growth and promotes bone density, making it a potentially useful compound for athletes and individuals looking to enhance their physical performance.

Potential Benefits of RAD-140 Testolone

Risks and Side Effects

While RAD-140 is considered relatively safe compared to anabolic steroids, it is essential to recognize potential risks and side effects:

Ensuring Quality and Legality

Given the growing popularity of SARMs, it is crucial to ensure that the product you are purchasing is of high quality and legal for use. Many unscrupulous sellers may market counterfeit or contaminated products, which can pose serious health risks. To safeguard your health, only purchase RAD-140 and other SARMs from reputable and trusted sources.

Conclusion

RAD-140 Testolone is a promising Selective Androgen Receptor Modulator that has captured the attention of athletes and bodybuilders seeking to enhance their performance and physique. With its potential benefits in muscle growth, strength enhancement, and recovery, RAD-140 shows promise as a safer alternative to traditional anabolic steroids. However, like any supplement, it is essential to approach RAD-140 with caution and ensure that you are well-informed about its potential risks and side effects. If considering RAD-140 or any other SARM, consulting with a healthcare professional is advised to make an informed decision and prioritize your health and well-being above all else.

If you suffer from back, neck, joint or general muscle problems, you may be able to get rapid access to NHS physiotherapy without having to see your GP first. The service is available in some areas, and your GP or hospital trust should be able to tell you whether it is available in your area.

What is self-referral physiotherapy?

Self referral physio Beverley therapy is a service that allows people to refer themselves directly to a physiotherapist for assessment. The physiotherapist will then decide whether the person needs treatment and, if so, what the action should be. Self-referral aims to improve access to physiotherapy and reduce waiting times while allowing individuals to control their care. This service is available nationwide, and people can learn more about it by visiting their local NHS trust or GP surgery.

Previously, people could only receive physiotherapy through a doctor’s referral. It was expensive and time-consuming for both patients and the health service. However, self-referral is now commonplace in some areas, and many physiotherapists encourage their patients to use this option if it suits them. Self-referral is especially useful for people with musculoskeletal problems like joint pain or injuries.

A physiotherapist can also help with many other conditions. For example, incontinence is a common condition that can be helped with physical therapy. Although many people may feel embarrassed about seeking this treatment, it is essential to know that incontinence is not something to be ashamed of and that a physiotherapist will make the patient as comfortable as possible.

Depending on your situation, you can self-refer to private physiotherapy and NHS physiotherapy services. You can also get physiotherapy through your workplace, as some employers offer occupational health services that include physiotherapy. In addition, some charities and patient groups provide physiotherapy to their members.

University Health Network (UHN) no longer requires a physician order to start a physiotherapy service in critical care areas. It is because a medical directive was implemented in the MSNICU and MSICU that permits physiotherapists to initiate PT self-referral for patients who meet specific criteria. It is a significant step forward in ensuring that critical care patients have access to the benefits of physiotherapy.

Benefits of self-referral physiotherapy

Self-referral is an ideal way to avoid long waiting times for physiotherapy treatment. Around 30% of people seeking GP consultations do so with a musculoskeletal complaint, such as back pain. It equates to 100 million appointments that self-referral could free up. It also saves money, with a study in 2012 showing that self-referral lowered costs by PS33 per patient. It was due to fewer ordered tests and lower levels of prescribing.

Self-referral to physiotherapy has many benefits for both patients and the healthcare system. It reduces waiting times, improves outcomes, and promotes self-care and empowerment. In addition, it saves the healthcare system time and resources by avoiding unnecessary medical investigations and referrals.

However, despite its apparent benefits, the NHS is still reluctant to introduce self-referral for physiotherapy. In England, only 31 per cent of clinical commissioning groups offer it to their patients. In contrast, Scotland has a self-referral scheme, and Wales plans to follow suit.

A recent study by the Chartered Society of Physiotherapy (CSP) found that patients with musculoskeletal conditions who self-referred to physiotherapy were more satisfied with their care than those who went through traditional channels. The study included interviews with patients and their GPs. It also reviewed charts of musculoskeletal patients in the MSNICU (a medical-surgical neurological intensive care unit) before and after introducing a self referral physio Beverley program.

Most interviewees who selected to self-refer to physiotherapy did so because they knew about the program from announcements and flyers in the hospital. However, some interviewees were unaware they could do so without a physician’s referral.

This lack of knowledge sometimes led to patients assuming that a physiotherapist would not treat them without a physician’s referral. It caused delays in the provision of physiotherapy. The study suggests that the NHS should use effective communication strategies to educate patients about physiotherapy and its benefits. It will help to ensure that more patients can benefit from the service and avoid the potential pitfalls of not recognizing when to seek treatment.

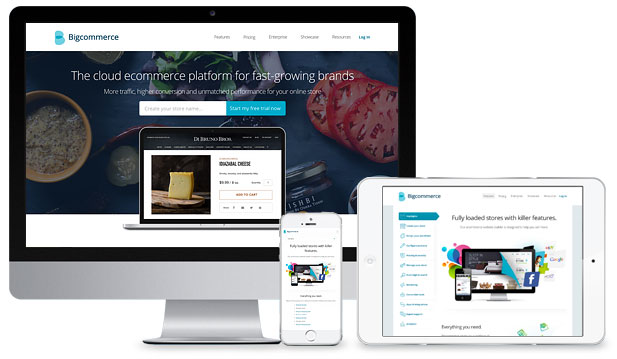

You may manage your store’s merchandise, inventory, customers, and other entities with the aid of import and export processes. BigCommerce provides tools for transporting data to and from your e-commerce store to help with these responsibilities. Therefore, numerous BigCommerce import procedures enable you to update product catalogs and customer information, while BigCommerce export procedures let you to make mass alterations to various entities. In the piece that follows, we concentrate on the platform’s export-related data flows.

BigCommerce does offer a few additional export entities even though it only supports CSV and XML files. BigCommerce order export and BigCommerce product export are thus available for your use. Additionally, you can move product-related items like photos, product options, and variations. Keep in mind that the system enables you to use filters to reduce the number of items you move from your website. We’ll go over how to export customers with addresses and items from a specific category in BigCommerce in the sections below. We examine the several data kinds that can automatically be exported as well as those that the platforms do not offer, such as the BigCommerce customer export, BigCommerce customer review export, or the whole BigCommerce database export. This tutorial will teach you how to export data from your e-commerce website, including orders, goods, product choices, product photos, customers, 301 redirects, categories, and customer reviews. We also show you how to add and adjust an export template in BigCommerce. Visit the relevant BigCommerce Import Guide for further details on the topic’s import-related aspects.

Data from your orders, customers, and products may be exported from BigCommerce and examined in spreadsheet format. Following that, you can make changes (such updating product prices or descriptions) and re-import the data into your store or transfer it to third-party software.

The BigCommerce default export allows you to make output as CSV or XML files in terms of supported file types. Exporting the data as a CSV is highly advised if you plan to input it again.

Orders, goods with product choices and SKUs, customers, 301 redirects, and even Ecommerce Analytics Reports are all covered by the BigCommerce export in terms of supported entities. Typically, the following use-cases derive from the default capabilities:

As you can see, the default BigCommerce export is really simple and clear. You may quickly move orders, clients, products, and 301 redirects from your store by following the instructions in this article. Improved Import & Export for BigCommerce, for example, is a third-party program that offers more complex procedures. In addition to offering a more sophisticated and adaptable BigCommerce export of orders, products, customers, and redirection, this plugin also enables you to alter categories, reviews, discount codes, and other items.

If you are on the hunt for a BigCommerce Development Company that can handle all your development service needs and migration requirements, look no further than AlwaysOpenCommerce.com! This amazing company takes pride in being at the forefront of BigCommerce development, providing top-notch services to cater to all e-commerce business owners.

Your 80th birthday celebration is just around the corner, and you need to be sure that it’s all the things that you hoped it would be. The wonderful news is that there are various great invite suggestions that you can utilize to plan the perfect soiree for your family and friends. Certainly, there are several elements of organizing a birthday shindig that you will certainly have to think about before when the great day arrives. Make sure to formulate a checklist of everything you need to do. A number of things include location, theme, guest list, entertainment, bash favors, and types of food. Proceed with reading for support getting going on planning your important day. 80th birthday save the date

An 80th birthday soiree is one of the most exciting celebrations of a woman’s life. It is the day you were brought forth, and it is the day when you commenced living. It is another momentous milestone reached and a terrific reason why to jubilate. The gathering may not start for several weeks but now is the time to begin the organizing.

When developing your 80th birthday shindig invites, it’s important to keep the birthday person’s personality in mind. Are they daring and outgoing? In the case that so, then use bright colors and exciting fonts to make their invitation stand out. For a slight approach, straightforward designs with popular typography can be used for a classic look. It is also considered important to include the date, time, and venue of the event. You may also prefer to include details about any special guests or things that will take place at the event. In the case that you have a theme for your function, feel free to mention it in your invitation as well. For an extra important touch, contemplate crafting a video invite for your 80th birthday affair. Video invites make it possible for you to include a personal touch and impart the tone of your event in an original and momentous way.

Producing a video invitation for your 80th birthday function is less troublesome than you may assume. To get begun, record any unforgettable moments or important words that you would like to feature in the video. This might be anything at all from childhood memoirs to dreams for the future. When you have all of the footage and music segments that you want to include, you can use a video-editing program or app to put it all together. If you’re not sure how to get things going, there are plenty of internet white papers that can assist shepherd you through the operation. You can even find premade templates that you can customize with your own pics and videos. As soon as your video is ready, upload it to an internet solution such as Rumble and share the link with your guests. This will make it effortless for everyone to see the invitation and get thrilled and chat about your significant event.

Memorialize your special day with personalized 80th birthday invitations. The advantages of making personalized invitations can not be overstated. Beyond making your guests feel wonderful, sending personalized invitations shows that you put in the effort to include them in your upcoming party. Whether or not you’re putting together a video invitation or an actual card, there are plenty of invitation strategies to enable you to turn your vision into fact. To make personalized birthday party invitations, initially, pick your preferred style and layout. You can also consider a theme for the invitations. There should be countless style preferences to choose from. With the use of on-the-web invitation themes, you can quickly individualize your party invitations instantly.

Finally, creating the perfect birthday party invitations doesn’t have to be a daunting task. With a bit of ingenuity and vision, you can make beautiful, standout, and meaningful invites that will make everyone thrilled for your particular day. Whether you make a choice to go with printed invitations, a video invite, or something personalized and standout, just try to remember to enjoy yourself and make it your own. Begin crafting your invitation right now.

Gone are the days when people sent simple and bland birthday party invites. Today, you have lots of choices when it comes to putting together personalized birthday party invitations. In case you find it problematic to think up your own invite using online themes just try to remember this. You can make sure you work with an experienced party planner to assist.

With the rising trend in computerized promoting and marketing and web-based interaction, invites can certainly be smoothly created with a desktop computer and a wifi link. Mailing those invites to and from localities across the globe has become effortless as well. Because of that, businesses have become very familiar with utilizing the internet to formulate postcards, invites, and digital message cards for all kinds of affairs. Business sessions, new product campaigns, and also basic business get-togethers. In addition, make sure to keep in mind those online events. We all know how important business meetings can certainly be. Internet or in-person functions do not matter much. That is true because the optimal ideas tend not to happen in the confines of the office space. Commercial events offer firms the likelihood to make purposeful connections and conjure up ideas. Furthermore, large affairs and stately events can raise a sizeable amount of cash for a range of satisfying causes and charities.

Using online invites for marketing and advertising, business affairs, sporting functions, fundraising, and product line releases needs to be easy. Keeping a concentration on the max amount of attendees you want is vital. Your key target ought to be to get as many people to show up as practical. By using your imagination and observing things through the eyes of your guests, you will formulate attention-grabbing and engaging invites that get the outcomes you are wanting. Personalization can be a substantial winner and should really be used whenever practical. Computerized invitations are most suitable for personalizing because they are uncomplicated to actualize.

Producing enthusiasm for fitness and health affairs, health care events, and pharmaceutic affairs aren’t effortless. Health and fitness functions are generally considered competitive while pharma, dental, and medical-related events are inclined to be typical and somewhat uninteresting in nature. That is why coupling those events with innovative advertising can certainly pay extras. Start with the invites. By using video invitations, you can surely get your guest list excited. Your odds of getting them to show up can intensify significantly. A clever video invite can certainly make the receivers chuckle and be entertained. By fulfilling that, your guest will be fixated on having a great time at the upcoming function and they will certainly be a lot more eager about making an appearance. Keep in mind that creative thinking with your invitations is the optimal way your event can be conveyed as a winner.

If you’re considering incorporating Ikaria Lean Belly Juice into your weight loss routine, you may be wondering about the best times to take it. In this article, we provide guidance on when to consume Ikaria Lean Belly Juice for optimal results and maximize its potential benefits.

One of the recommended times to take Ikaria Lean Belly Juice is before meals. Consuming the juice approximately 15 to 30 minutes before your main meals can help curb your appetite and promote a feeling of fullness. By reducing your hunger levels, you may be less likely to overeat or indulge in unhealthy food choices during your meal. This can be particularly beneficial if you struggle with portion control or tend to eat larger meals.

Taking Ikaria Lean Belly Juice in the morning can provide a refreshing start to your day and kick-start your metabolism. As you wake up, your body may be in a fasted state, and consuming the juice can help provide vital nutrients and hydration. The blend of ingredients in Ikaria Lean Belly Juice, such as green tea extract and African mango extract, can offer an energizing boost to enhance your focus and support physical activity throughout the day.

For some individuals, the mid-afternoon slump can bring about cravings and a decrease in energy levels. This is an ideal time to have a serving of Ikaria Lean Belly Juice. Its natural ingredients, like Garcinia Cambogia and raspberry ketones, may help control your appetite and provide an energy lift without resorting to sugary snacks or caffeinated beverages. This can help you stay on track with your weight loss goals and maintain steady energy levels until the end of the day.

If you have an exercise routine, taking Ikaria Lean Belly Juice before your workout can be advantageous. The juice contains ingredients like green coffee bean extract and green tea extract, which have been linked to improved fat metabolism and increased fat oxidation. By consuming it before your workout, you can potentially enhance your body’s ability to burn stored fat as fuel during exercise. Additionally, the natural energy boost from African mango extract can give you the stamina to power through your workout with increased intensity.

Although it is not necessary to take Ikaria Lean Belly Juice right before bed, some individuals find it beneficial to consume a serving as part of their evening routine. The juice’s blend of ingredients, such as raspberry ketones and green tea extract, can support overall metabolism and fat burning even during restful sleep. However, it is important to listen to your body and consider any potential effects on your sleep patterns. If you find that consuming the juice close to bedtime affects your sleep quality, it may be best to adjust the timing accordingly.

To maximize the benefits of Ikaria Lean Belly Juice, consider incorporating it into your daily routine at strategic times. Taking it before meals, in the morning, mid-afternoon, pre-workout, or even before bedtime can help you control your appetite, boost your metabolism, and support your weight loss efforts. Remember to follow the recommended dosage provided by the manufacturer and adjust the timing based on your individual needs and preferences.

If you are facing a drug test specifically targeting methamphetamine (meth), it’s important to understand the strategies that can help you pass the test successfully. In this comprehensive guide, we will provide you with effective strategies to increase your chances of passing a drug test for methamphetamine.

Before we delve into the strategies, it’s crucial to understand how methamphetamine is metabolized in the body and how it can be detected in drug tests. Methamphetamine is rapidly metabolized into amphetamine and other metabolites, which are what drug tests typically look for to indicate recent methamphetamine use.

Now let’s explore effective strategies to help you pass a drug test specifically targeting methamphetamine. It’s important to note that these strategies should be used responsibly and in compliance with applicable laws and regulations.